dc income tax withholding calculator

2013 Income Tax Withholding Instructions and Tables. Enter annual income from highest paying job.

Everything You Need To Know About How Partnerships Are Taxed

Find your pretax deductions including 401K flexible account contributions.

. See withholding on residents nonresidents and expatriates. Federal and DC Paycheck Withholding Calculator. Number of Dependents Under Age 17.

Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount computed in. Capital has a progressive income tax rate with six tax brackets ranging from 400 to 1075. Child birth or adoption.

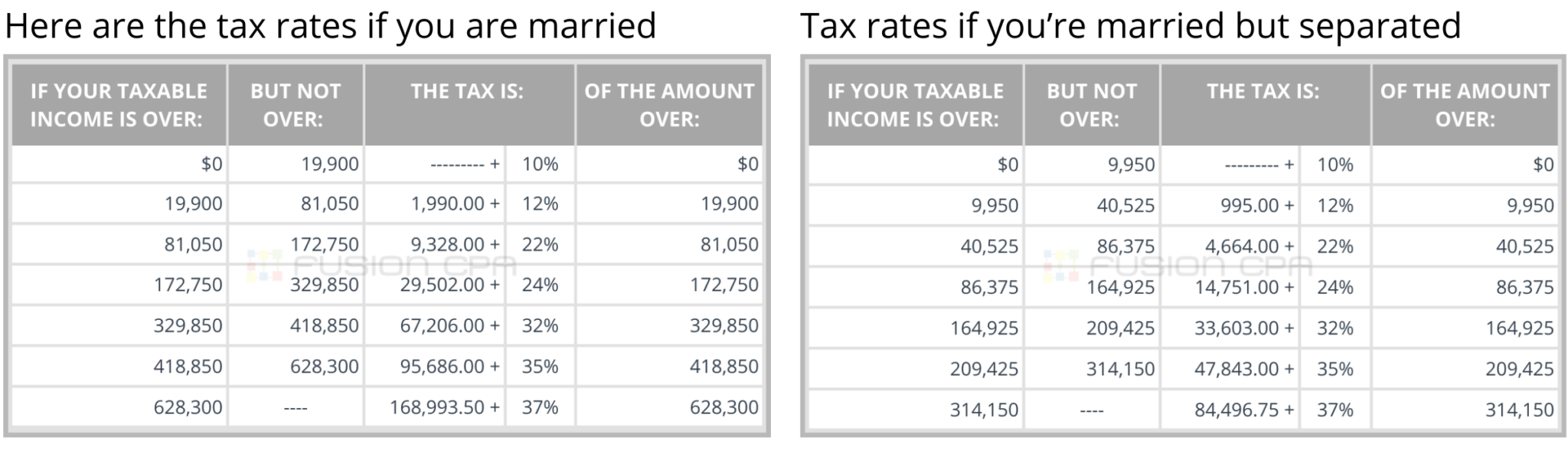

Apply the taxable income computed in step 5 to the following tables. 2011 Income Tax Withholding Instructions and Tables. Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan.

First we calculate your adjusted gross income AGI by taking your total household income and reducing it by certain items such as contributions to your 401k. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Updated for your 2021-2022 taxes simply enter your tax information and adjust your withholding to understand how to maximize your tax refund or take-home pay.

2014 Income Tax Withholding Instructions and Tables. NOTE Withholding is. When you have a major life change.

File with employer when starting new employment or when claimed allowances change. 2014 Income Tax Withholding Instructions and Tables. Quarterly Estimated Tax Calculator - Tax Year 2022.

Withholding Formula District of Columbia Effective 2022. Not expect to owe any DC income tax and expect a full refund of all DC income tax withheld from me. New job or other paid work.

The tax rates for tax years beginning after 12312021 are. Use this calculator to estimate the amount of money that would be withheld from your monthly pension payments for federal income tax based on the IRS current tax tables and various tax filing options. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

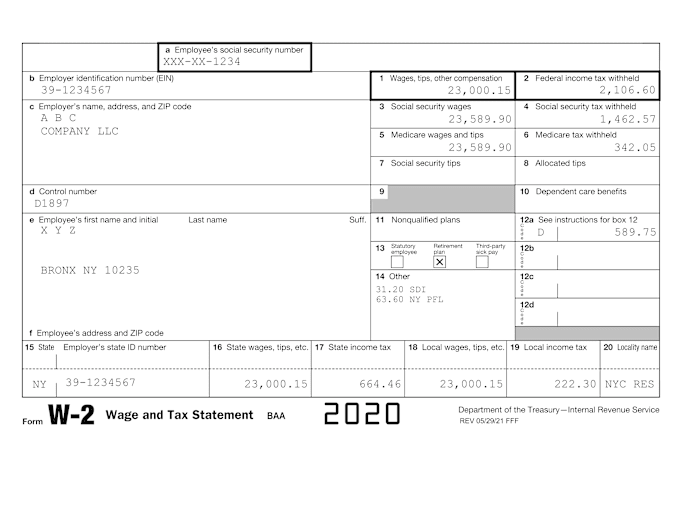

Overview of District of Columbia Taxes. Medicare Tax is 145 of each employees taxable wages until they reach 200000. 1101 4th Street SW Suite 270 West Washington DC 20024.

How Income Taxes Are Calculated. Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages. File with employer when requested.

Withholding Formula District of Columbia Effective 2021. FICA taxes are made up of two components Social Security Tax and Medicare Tax. Social Security Tax is equal to 62 of your employees taxable wages up to an annual total of 147000.

This Federal Income Tax Withholding Calculator is intended to be used as a tool to estimate your own monthly federal income tax withholding. If you have any questions please contact our Collection Section at 410-260-7966. Your average tax rate is.

Income Tax Calculator 2021. If you have a third job enter its annual income. Income tax brackets are the same regardless of filing status.

When to Check Your Withholding. Individual and Fiduciary Income Taxes The taxable income of an individual who is domiciled in the District at any time during the tax year or who maintains an abode in the District for 183 or more days during the year or of a DC estate or trust is subject to tax at the following rates. D-4A Fill-in Certificate of Non-residence in DC.

After a few seconds you will be provided with a full breakdown of the tax you are paying. If you make 70000 a year living in the region of Washington DC USA you will be taxed 13271. The District of Columbia income tax has six tax brackets with a maximum marginal income tax of 895 as of 2022.

Check your tax withholding at year-end and adjust as needed with a new W-4. D-4 and file it with his her employer. Enter annual income from 2nd highest paying job.

2012 Income Tax Withholding Instructions and Tables. Use this calculator to determine the amount of estimated tax due for 2022. Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages.

Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount computed in. Check your tax withholding every year especially. Determine the dependent allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income.

Rates for Tax Year 2022 Tax Rates. If you changed your tax withholding mid-year. 2015 Income Tax Withholding Instructions and Tables.

Quarterly Estimated Tax Calculator -. Has relatively high income tax rates on a nationwide scale. Dependent Allowance 1775 x Number of Dependents.

As an employer you are responsible for matching the same amount each. Enter pay periods per year of your highest paying job. Multiply the adjusted gross biweekly wages by 26 to obtain the annual wages.

Total expected income this year. D-4 Fill-in Employee Withholding Allowance Certificate.

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

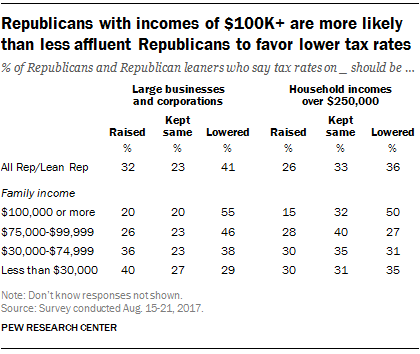

Americans Tax Bills Are Below Average Among Developed Nations Pew Research Center

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation

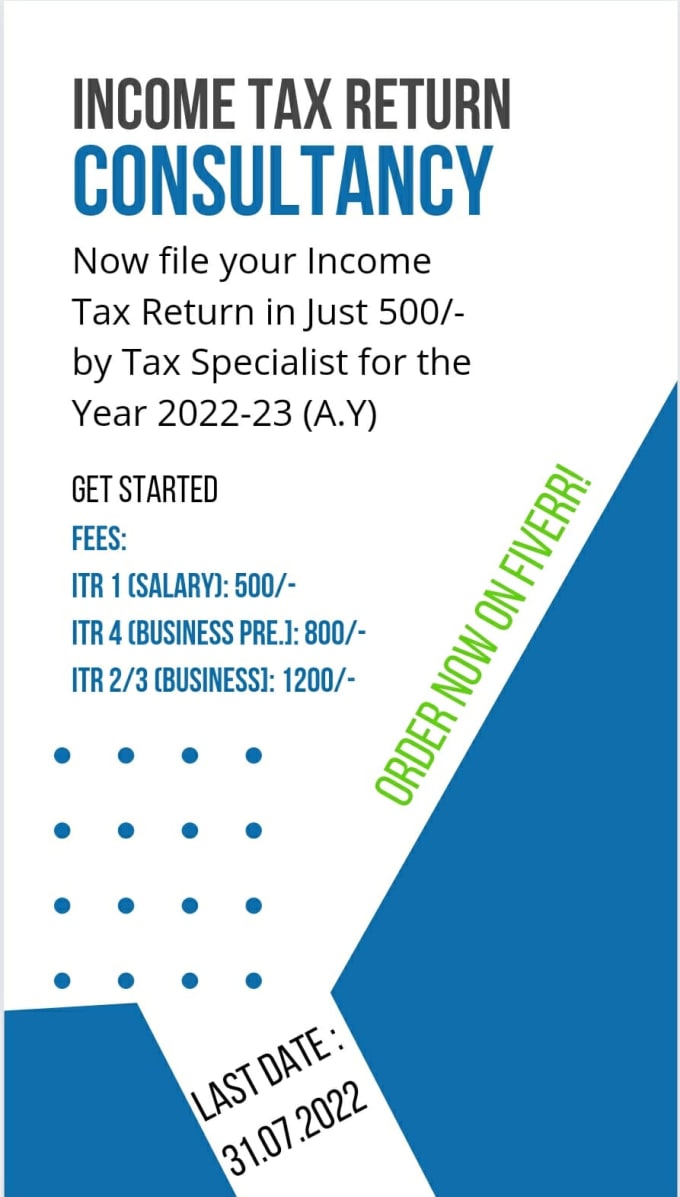

24 Best Income Tax Services To Buy Online Fiverr

Follow Steve Rosenthal S Stevertax Latest Tweets Twitter

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

8 Things To Know About Oregon S Tax System Oregon Center For Public Policy

How Do State And Local Sales Taxes Work Tax Policy Center

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

24 Best Income Tax Services To Buy Online Fiverr

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

24 Best Income Tax Services To Buy Online Fiverr

How Do State And Local Sales Taxes Work Tax Policy Center

Estimating The Corporate Income Tax Gap In Technical Notes And Manuals Volume 2018 Issue 002 2018

South Dakota Tax Rates Rankings Sd State Taxes Tax Foundation

Paid Family And Medical Leave Sap Blogs

24 Best Income Tax Services To Buy Online Fiverr

Maryland Tax Rates Rankings Maryland State Taxes Tax Foundation